GSTR 2 : Return, Format and Rules

Hitech BillSoft helps you in filling GSTR-2 returns

and reduce your monthly worries.

Free Version Download

GSTR 2 prescribes the details to be provided by the taxpayer in relation to inward supplies made for the relevant period. GSTR 2 needs to be filed by every taxpayer except Composition Scheme taxpayers, Non-Resident Foreign taxpayers, TDS deductors, E commerce Operators and Input Service Distributors as there are separate returns for them. This return is required to be filed by the 15th of subsequent month. (Ex: GSTR-2 for the transaction month of April has to be filed before 15th May).

The government has notified new GST Return formats in this regard and removed the mandatory requirement to quote HSN codes for goods and SAC codes for services in each table. The GST Return Formats have been updated to ease the process and simplify compliance for taxpayers under GST.

1. What is GSTR-2?

2. When is GSTR-2 important?

3. When is GSTR-2 due?

4. Who should file GSTR-2?

5. What happens if GSTR-2 is not filed?

6. Late fees and penalty

7. How to revise GSTR-2?

8. What is GSTR-2A?

What is GSTR-2?

GSTR-1 is a monthly report done by all regular and casual registered taxpayers that needs to include details about the inward supplies for the taxable period. In layman terms, GSTR 2 contains details about all the purchase transactions that a registered dealer has done in a month.

When is GSTR-2 important?

GSTR-2 contains details of all the purchases transactions of a registered dealer for a month. It will also include purchases on which reverse charge applies.

The GSTR-2 filed by a registered dealer is used by the government to check with the sellers' GSTR-1 for buyer-seller reconciliation.

When is GSTR-1 due?

As per the GST Act, GSTR-2 due date for filing GSTR-2 is 15th of next month.

Who has to file GSTR-2?

Every registered person is required to file GSTR-2 irrespective of whether there are any transactions during the month or not. They can do this though the government GST online portal, the offline portal that is provided specially for returns or through a GST Suvidha Provider (GSP).

There are some categories of registered persons who are exempted from filing GSTR-2, these include:

- Input Service Distributors (ISD)

- Registered under the Composition Scheme

- Non-resident taxable person

- Taxpayer liable to collect TCS

- Taxpayer liable to collect TDS

- Suppliers of online information and database access or retrieval services (OIDAR), who have to pay tax themselves (as per Section 14 of the IGST Act)

What happens if GSTR-2 is not filed?

If GSTR-2 return is not filed then the next return GSTR-3 cannot be filed. Hence, late filing of GST return will have a cascading effect leading to heavy fines and penalty.

Late fees and penalty?

If you delay in filing, you will be liable to pay interest and a late fee. Interest is 18% per annum. It has to be calculated by the taxpayer on the amount of outstanding tax to be paid. The time period will be from the next day of filing (16th of the month) to the date of payment. The late fee is ₹100 per day per Act. So it is 100 under CGST & 100 under SGST. Total will be ₹200/day. The maximum is ₹5,000.There is no late fee on IGST.

How to revise GSTR-2?

GSTR-2 once filed cannot be revised. Any mistake made in the return can be revised in the next month's return. It means that if a mistake is made in April GSTR-2, rectification for the same can be made in May's GSTR-2

What is GSTR-2A?

When a seller files his GSTR-2, the information is captured in GSTR-2A. GSTR-2A is a purchase-related tax return that is automatically generated for each business by the GST portal. It takes information from the seller’s GSTR-1. You are required to verify (and amend) this return before filing in on GST Portal.

Quick links

Helps you in managing your business better

Hitech BillSoft is India's most simple and powerful billing software comes loaded with features like sales management, purchase bills, supplier accounts, barcode generator, biometric attendance, staff salary, reminders, pos printer support, android app, and many more to support your business.

Quick review

NEW

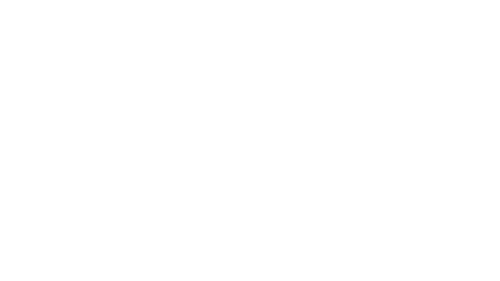

SMS/Email Support

Our billing software comes integrated with SMS/Email server which helps in better communication with your clients.

NEW

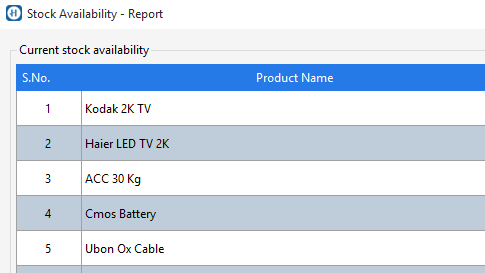

Inventory Tracking

Hitech BillSoft helps in tracking stock movements, purchase bills, supplier accounts, low stock alerts, fast moving goods, and many more.

NEW

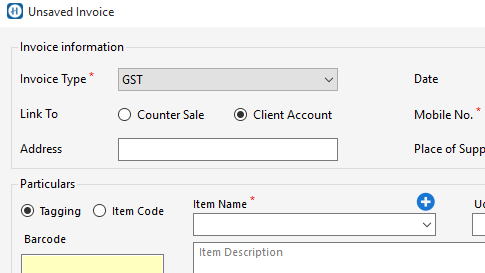

Multi-size Invoices

Our billing software comes with multiple size invoice templates which allows to print invoices in A4, A5 and PoS Receipt (upto 4 inch.) sizes.

Billing becomes more easier.

Download Hitech BillSoft latest version from anywhere, and it's free. Supports Windows 7, 8, 10 and 11.

DOWNLOAD FREE EDITION

*Paid version also available with lifetime validity.