Try the Hitech Billsoft Software today and grow your business

Join Millions of Business Owners already saving time and

money with Hitech Billsoft.

Hitech BillSoft helps you in filling GSTR-1 returns and reduce your monthly worries.

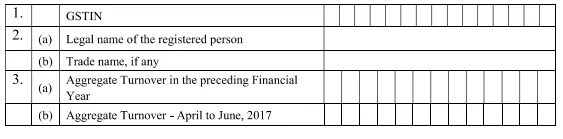

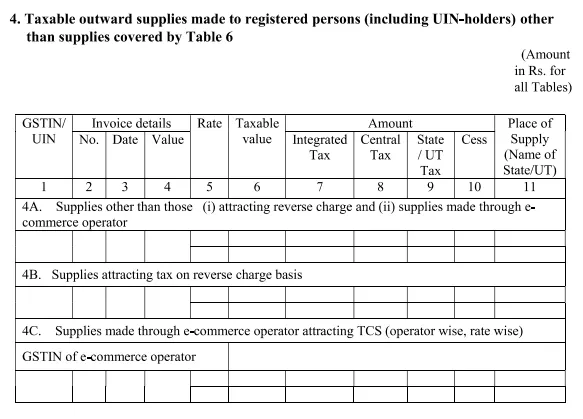

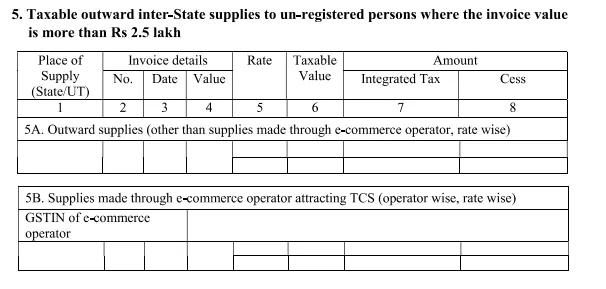

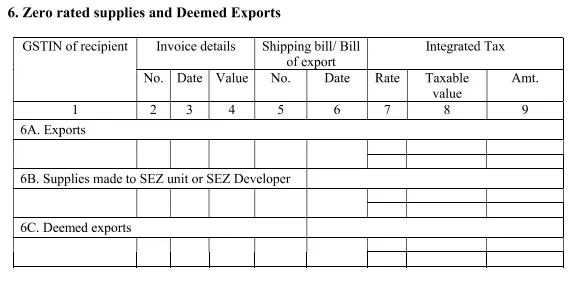

GSTR 1 prescribes the details to be provided by the taxpayer in relation to outward supplies made to the buyer for the relevant period. GSTR 1 needs to be filed by every taxpayer except Composition Scheme taxpayers, Non-Resident Foreign taxpayers, TDS deductors, E commerce Operators and Input Service Distributors as there are separate returns for them. This return is required to be filed by the 10th of subsequent month. (Ex: GSTR-1 for the transaction month of April has to be filed before 10th May).

The government has notified new GST Return formats in this regard and removed the mandatory requirement to quote HSN codes for goods and SAC codes for services in each table. The GST Return Formats have been updated to ease the process and simplify compliance for taxpayers under GST.

GSTR-1 is a monthly report done by all regular and casual registered taxpayers that needs to include details about the outward supplies for the taxable period. In layman terms, GSTR 1 contains details about all the sales transactions that a registered dealer has done in a month. The GSTR 1 that a registered dealer files is used by the government to auto complete GSTR 3 for said dealer and GSTR 2A for dealers to whom the respective supplies have been made. GSTR-1 has to be filed even in situations where there is no business activity in a given taxable period.

Every registered person is required to file GSTR-1 irrespective of whether there are any transactions during the month or not. They can do this though the government GST online portal, the offline portal that is provided specially for returns or through a GST Suvidha Provider (GSP).

There are some categories of registered persons who are exempted from filing GSTR 1, these include:

Return once filed cannot be revised. Any mistake made in the return can be rectified in the next periods (month/quarter) return. It means that if a mistake is made in August GSTR-1, rectification for the same can be made in September’s GSTR-1

Late Fees for not filing GSTR-1 is ₹200 per day of delay (₹100 as

per CGST Act and ₹100 as per SGST Act. The late fees will be

charged from the date after the due date.

Update : The late fees have been reduced to ₹50

per day and ₹20 per day (for nil return).

The following are the advantages of availing composition scheme :

Yes, filing GSTR 1 is mandatory. If your total sales for a year is less than Rs 1.5 crore you need to file the return on a quarterly basis.

You can upload invoices anytime. It is highly advised that you upload invoices at regular intervals during the month to avoid bulk upload at the time of filing return. This is because bulk upload takes a lot of time.

After uploading invoices you can make changes multiple times. There is no restriction on changing invoices after uploading them. But you can change an invoice only before submitting a return. Once submitted the numbers are frozen.

GSTR-3B is a simple return to be filed by traders on a monthly basis. You still need to file the return on a monthly or a quarterly basis.

GSTR-1 should not be filed by you. GSTR-4 on a quarterly basis has to be filed by a taxpayer opting for composition scheme.

GSTR-1 is a return where details of sales are filed with the government. No tax has to be paid after filing this return. The tax has to be paid at the time of filing GSTR-3B (until March 2018).

Join Millions of Business Owners already saving time and

money with Hitech Billsoft.