Generate

E-invoices

and

E-way Bills in seconds

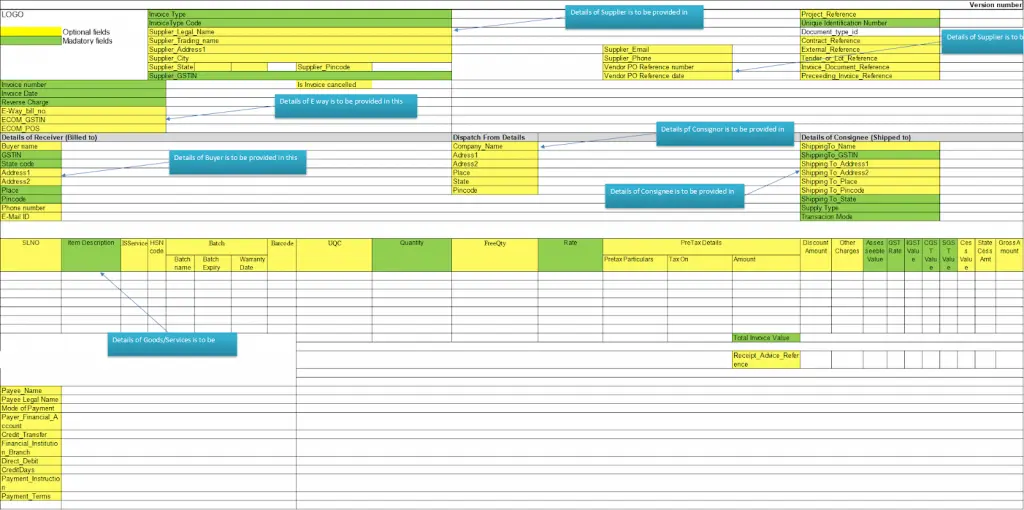

Generate 100% GST-compliant e-invoices and e-way bills in a single click. Hitech Billsoft helps you eliminate errors, avoid penalties, and save valuable time so you can focus on your business.