E-way bill or Electronic-way bill is a document introduced under the GST regime that needs to be generated before transporting or shipping goods worth more than INR 50,000 within state or inter-state. The physical copy of e-way bill must be present with the transporter or the person in charge of the conveyance and should include information such as goods, recipient, consignor and transporter. The e-way bill was rolled out nationwide on 1st April 2018.

1. What is GST E-Way Bill?

2. When is the E-Way Bill applicable?

3. When should the E-Way Bill be generated?

4. What is the validity of E-Way Bill?

5. Who should generate the E-Way Bill?

6. How to generate the E-Way Bill?

7. Can E-Way Bill be generated for consignments of value less than ₹50,000?

8. What happens if multiple consignments are transported in one vehicle?

9. What happens if goods are transferred from one vehicle to another vehicle in the course of transit?

10. What happens if E-Way Bill is generated but goods are not transported?

11. What must be done if the validity of the e-way bill expires due to vehicle breakdown or other circumstances?

What is GST E-Way Bill?

E-Way Bill is an Electronic Way bill for movement of goods to be generated on the eWay Bill Portal. A GST registered person cannot transport goods in a vehicle whose value exceeds ₹50,000 (single invoice / bill / delivery challan) without an e-way bill that is generated on E-Way Bill Portal.

Alternatively, E-Way bill can also be generated or cancelled through SMS, Android App and by site-to-site integration through API. When an e-way bill is generated, a unique E-Way Bill Number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

When is the E-Way Bill applicable?

It is applicable for any consignment value exceeding ₹50,000. Even in case of inward supply of goods from unregistered person, E-Way Bill is needed.

When should the E-Way Bill be generated?

The E-Way Bill needs to be generated before the commencement of movement of goods.

What is the validity of E-Way Bill?

Less than 100 KM : 1 Day

Every 100 Km or part thereof : 1 Additional Day

The validity period will be counted from the time of generation of the E-Way Bill. The validity period of the E-Way Bill may be extended by the commissioner for certain categories of goods, as specified in the notification issued in this regard.

Who should generate the E-Way Bill?

When goods are transported by a registered person, either acting as a consignee or consignor in his own vehicle, hired vehicle, railways, by air or by vessel, the supplier or recipient of the goods should generate the E-Way Bill.

When the goods are handed over to a transporter, the E-Way Bill should be generated by the transporter. In this case, the registered person should declare the details of the goods in a common portal.

In case of inward supplies from an unregistered person, either the recipient of supply or the transporter should generate the E-Way Bill.

How to generate the E-Way Bill?

Form GST EWB-01 is an E-Way Bill form. It contains Part A, where the details of the goods are furnished, and Part B contains vehicle number.

Can E-Way Bill be generated for consignments of value less than ₹50,000?

Yes, either a registered person or a transporter can generate an E-Way Bill although it may not be mandatory.

What happens if multiple consignments are transported in one vehicle?

The transporter should generate a consolidated E-Way Bill in the Form GST EWB 02 and separately indicate the serial number of E-Way Bill for each of the consignment.

What happens if goods are transferred from one vehicle to another vehicle in the course of transit?

Before transferring the goods to another vehicle and making any further movement of such goods, the transporter needs to update the details of conveyance in the E-Way Bill on the common portal in Form GST EWB 01.

What happens if E-Way Bill is generated but goods are not transported?

The E-Way Bill can be cancelled electronically on the common portal within 24 hours of its generation. The E-Way Bill cannot be cancelled if it has been verified by an officer during transit.

What must be done if the validity of the e-way bill expires due to vehicle breakdown or other circumstances?

The validity of the e-way bill can be extended under circumstance of exceptional nature, law and order issue, trans-shipment delay, accident of conveyance etc by updating the reason for extension and the details in Part B of Form GST EWB-01.

Quick links

Helps you in managing your business better

Hitech BillSoft is India's most simple and powerful billing software comes loaded with features like sales management, purchase bills, supplier accounts, barcode generator, biometric attendance, staff salary, reminders, pos printer support, android app, and many more to support your business.

Quick review

NEW

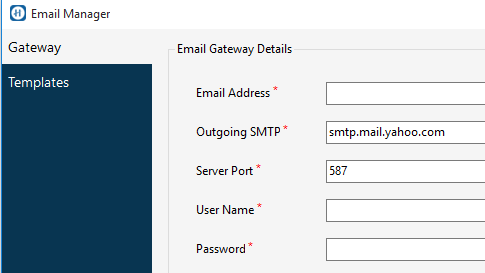

SMS/Email Support

Our billing software comes integrated with SMS/Email server which helps in better communication with your clients.

NEW

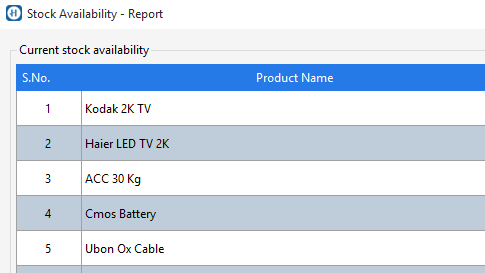

Inventory Tracking

Hitech BillSoft helps in tracking stock movements, purchase bills, supplier accounts, low stock alerts, fast moving goods, and many more.

NEW

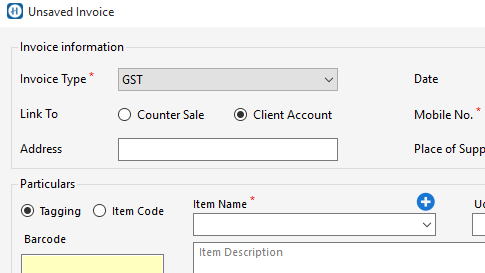

Multi-size Invoices

Our billing software comes with multiple size invoice templates which allows to print invoices in A4, A5 and PoS Receipt (upto 4 inch.) sizes.

Billing becomes more easier.

Download Hitech BillSoft latest version from anywhere, and it's free. Supports Windows 7, 8, 10 and 11.

DOWNLOAD FREE EDITION

*Paid version also available with lifetime validity.